By Jim Rieniets, Chairman, TBA Government Relations Committee, President/CEO, InsBank, Nashville

The TBA’s annual Washington Conference will be upon us very shortly in mid-May. As the TBA staff is preparing our agenda and scheduling time with our congressional delegation and regulatory agency leaders, I encourage bankers to join us for this year’s government relations trip. Unless your calendar is simply prohibitive, please consider the following reasons for joining the group in D.C., May 14–16.

Strength in numbers

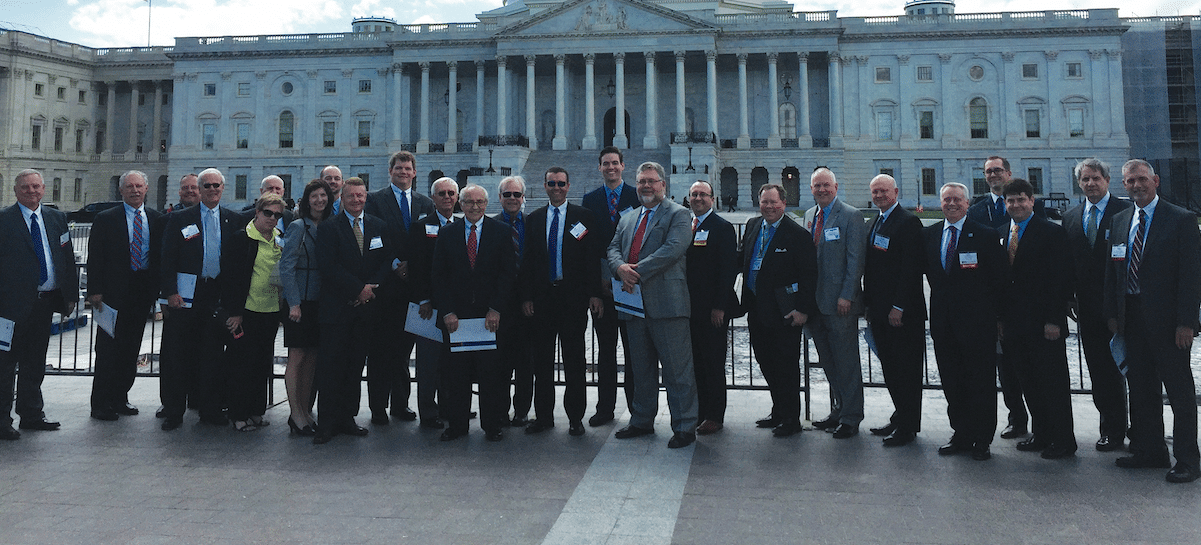

Time and time again, we are told by regulators and elected officials alike that the number of bankers participating on lobbying trips has impact. To us, this seems somewhat shallow and feels like form over substance. To the audience, we are engaging in Washington, however, the number of people filling their conference rooms on Capitol Hill or beyond the TSA-like security at a regulatory agency is a proxy for how strong we feel about matters affecting the banking industry. As the old saying goes, “perception is reality.” Unfortunately, we are told periodically that our counterparts in the credit union industry have developed a habit of bringing large delegations to Washington. This both underscores the potential impact of showing up in large numbers and reminds us that we have to continue the battle against credit unions’ further mission creep into the banking world.

A great time to catch up with your peers

The TBA staff does a spectacular job of scheduling visits with regulators, elected officials, trade associations, etc., but the bus tour-esque experience, receptions, and dinners provide a great opportunity to visit with your peers to discuss the topics at hand, catch up with old friends, and make new ones. It is an impressive collection of leaders within our industry, and I suspect that most participants find the peer interaction an added bonus beyond the lobbying experience.

Efficacy of specific examples

Washington bureaucrats and elected officials hear plenty of noise about bankers being unhappy with laws and regulations. This is a given, and we don’t have to tell them we are unhappy. But there is real impact to having practitioners in the industry look a congress- man or agency head in the eye and cite specific ways that regulatory excesses are making it difficult to serve customers. Often the simplest of anecdotes about a customer not able to meet a closing date on a house or a client’s complaints about the volume of documents required for borrowing a relatively small amount of money can have significant impact on our Washington audience.

There is currently a more receptive audience in Washington D.C. to bankers’ concerns than in many years past. There are pending regulatory relief bills in both the House and Senate, and new leadership appointees within regulatory agencies. In this moment, banking leaders in Tennessee have a unique opportunity to swing the pendulum of momentum for their industry, and that opportunity can be best realized if we show up in relatively large numbers. See you in May!